SUSTAINABLE FINANCE

Sustainable finance refers to the integration of ESG criteria into financial services and investment decisions. It encompasses a broad range of activities, including sustainable lending, sustainable investment, and the development of financial products that promote environmental and social sustainability. Trust Bank PLC invests in sustainable finance and green finance to promote environmental and social sustainability.

Trust Bank PLC believes, sustainable finance is not limited to environmental concerns; it also addresses social issues such as labor rights, gender equality, and community development. By incorporating ESG factors into our decision-making processes, we can identify and manage risks related to sustainability, while also capitalizing on opportunities to create long-term value for their stakeholders.

To promote sustainable financing through inclusive financing of CMSME cottages, marginalized people and overall Bangladesh Bank (BB) recognized products such as SFD 1,000 crore scheme, Green Transformation Fund and Technology Development/Upgradation Fund etc. Trust Bank has entered into an agreement with BB to avail this facility for further financing in the sustainable sector. Cottage, Micro, Small & Medium Enterprise Financing (CMSME) financing of the Bank ensures inclusive & sustainable economic growth through CMSME development with special focus on women entrepreneurship development. For this reason, cluster based financing model has been playing as a catalyst in the growth of cottage and micro segment in the country.

Our product named “Trust Prantik” is specially design for the group of people who doesn’t have the privilege of having formal financial services for personal need and to reinforce their income generating activities. This product is aimed to provide loan for agriculture & agro based activities, grass root level entrepreneurs, marginal & landless farmers and support other low income individuals such as garments workers & Other service holders, masons, electricians, plumbers, fishermen, goldsmith, weavers, blacksmiths, potters, carpenters, painters, vegetable sellers etc.

Sustainable financing position as on December 31, 2024.

GOVERNANCE, SUSTAINABILITY AND COMPLIANCE

One of the key challenges in sustainable and green finance is apathy of standardized environmental, social and governance (ESG) metrics. However, our central bank has issued a robust guideline to maintain ESG standards. Our central bank is highly committed to implementing Environmental and Social Risk Management (ESRM) guidelines to promote best practices in ESG. To ensure standardization, they have updated the guidelines accordingly.

Trust Bank PLC is increasingly collaborating with stakeholders and regulators to develop standardized ESG metrics and tools in line with Bangladesh Bank’s guidelines and frameworks. This tools allow financial institutions to analyze large volumes of ESG data, identify emerging risks (environment, social & general risks) and develop strategies to mitigate these risks. By incorporating ESG factors into our decision-making processes, Trust Bank PLC can identify and manage risks related to sustainability, while also capitalizing on opportunities to create long-term value for the stakeholders.

Trust Bank plc has developed some products to meet customers' increasing demand for financial solutions that align with their values and drive positive environmental and social impact. Our commitment is to sustainable investment which has strengthened Green Financing strategy in line with the United Nations’ Sustainable Development Goals on affordable and clean energy, economic growth and climate action. We verify it through a mandatory social and environmental screening process in our project financing activities.

For two consecutive years (2022 and 2023), Trust Bank PLC was recognized as the 'Top Sustainable Bank’. This rating has been declared by Bangladesh Bank based on the Bank’s performance on four indicators which are Sustainable Finance, Green Refinance, Corporate Social Responsibility and Core Banking Sustainability.

Major achievement:

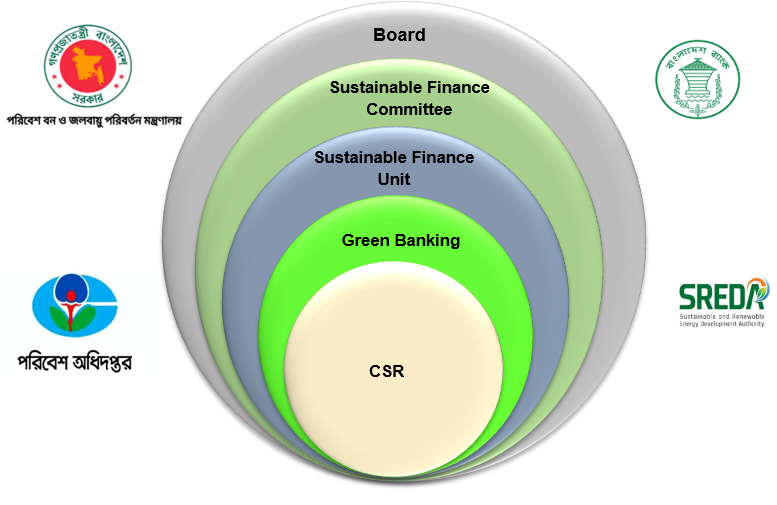

Governance structure adhering to the terms of reference outlined by Bangladesh Bank through guidelines and circulars, formation of Sustainable Finance Unit is done under Credit Risk Management Division. And the Sustainable Finance Committee is formed with the senior management of the bank who serve as the head authority for supervising all the bank’s sustainability activities under the guidance of the Board. The bank’s sustainability activities are performed through sustainable banking and corporate social responsibility with the vision of making a value based banking for a greener and sustainable future.

Sustainable finance refers to the process of taking Environmental, Social and Governance (ESG) considerations into account when making investment decisions leading to sustainable economic activities and projects.

E&S Safeguard Policy of TBL:

SUSTAINABLE FINANCE UNIT:

The Sustainable Finance Unit (SFU) of the bank ensures that funds are properly administered and disbursed in accordance with the bank’s vision, objectives, and areas of focus. We have a well-defined structure for reviewing and monitoring our CSR initiatives. The SFU of the bank has created policy guidelines on Corporate Social Responsibility and processes to monitor and evaluate our CSR programs. This not only helps in designing the target group but also in monitoring and evaluating the program in a structured way.