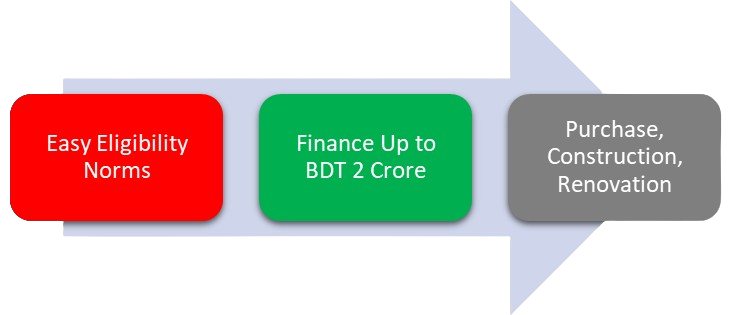

Fulfill Your Dream of Owning a Home with Apon Nibash House Finance Loan! Whether you're looking to purchase, construct or renovate your dream home, we have got you covered.

Features:

- For Property purchase, home construction or renovation

- Loan amount up to BDT 2 crore

- Loan tenure 1 year to 25 years

- Market competitive rate

- Loan up to 70% of property value

Please check our Schedule of Charges at https://www.tblbd.com/index.php/rates-and-charges

Segments:

- Salaried Personnel

- Self-employed Professionals

- Business Persons

- Landlord/Landlady

Age:

- Min: 25 years

- Max: 65 years at loan maturity

Property Age:

- Max: 20 years at underwriting

- Not to exceed 40 years at loan end

- For list of required standard documents, please click here

Click Here: https://eservice.tblbd.com/website/BranchList