Unlock financial flexibility with Trust Bank’s Loan Against Salary! Whether it’s miscellaneous household appliances, furniture, travel plans, or unexpected expenses, we’re with you every step of the way. Apply now and turn life’s surprises into opportunities.

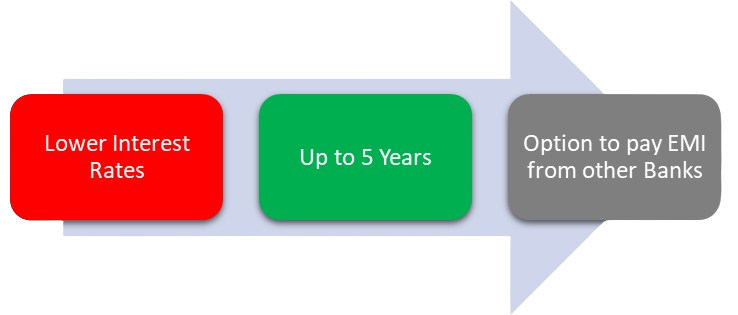

- 1 year to 5 years tenure

- Ranges up to BDT 20 Lac

- EMI from other banks directly

Features

- Loan amount up to BDT 1 Lac to BDT 20 Lac

- Loan tenure 1 year to 5 years

- No hidden charges

- Competitive interest rate

Please check our Schedule of Charges at https://www.tblbd.com/index.php/rates-and-charges

Segments:

- Salaried executives

Age Requirements:

- Minimum: 23 years

- Maximum: 65 years at loan maturity

Experience Requirements:

- Non-Government Executives:

- 1 year of uninterrupted service

- 6 months as a permanent, confirmed employee

- Government Employees:

- Minimum 1 year of service

- TBL Payroll Customers:

- 6 months' service, confirmed employee

- 3 months' salary credited through TBL

- For list of required standard documents, please click here

Branch Address Page: https://eservice.tblbd.com/website/BranchList