The 62nd meeting of Trust Bank Shariah Supervisory Committee

The 62nd meeting of Trust Bank Shariah Supervisory Committee was held on 25th June 2025 at Head Office of the Bank. The Chairman of Trust Bank Shariah Supervisory Committee Dr. Mohammad Monzur-E-Elahi presided over the meeting. Members of the Shariah Supervisory Committee including Vice-Chairman Dr. Muhammad Saifullah & Member Secretary-Mawlana Mahmudul Haque, Managing Director-Mr. Ahsan Zaman Chowdhury, DMD & Head of Islamic Banking-Md. Kamal Hossain Sarker and Officials of Islamic Banking Division were also present in the meeting.

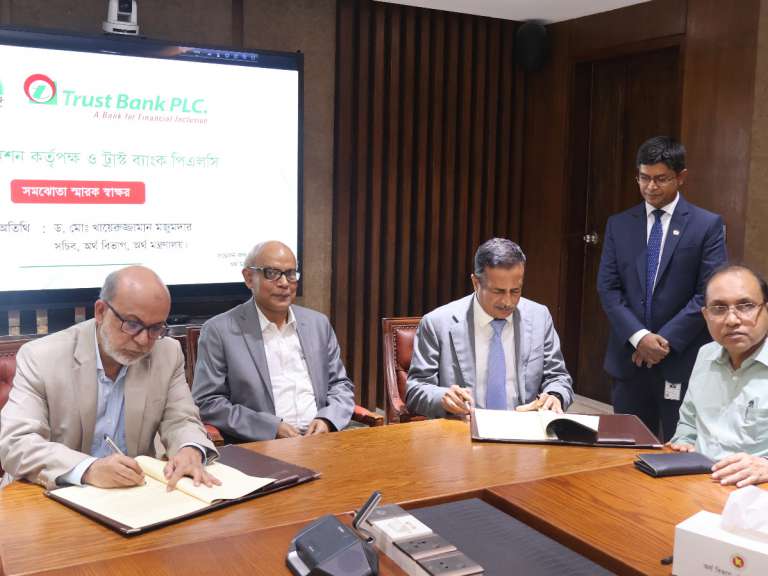

Trust Bank signs MoU with National Pension Authority

Trust Bank PLC has signed a Memorandum of Understanding (MoU) with the National Pension Authority (NPA) to promote Universal Pension Schemes. Md Khairuzzaman Mozumder, Secretary of the Ministry of Finance was present as the Chief Guest in the program. Ahsan Zaman Chowdhury, Managing Director and CEO of Trust Bank and MD. Mahiuddin Khan, Executive Chairman of the NPA, penned the MoU on behalf of their respective organization at Ministry of Finance.